EPF deduction in leave bonus and conveyance and laundry allowance is mandatory. All payments for wages are subject to EPF deductions.

Employee Provident Fund Epf Contributions Rates Benefits

Payment in lieu of notice of termination of service payment given when employees service is terminated Directors fee.

. For the month of September they receive a bonus of RM250 as. In general all monetary payments that are meant to be wages are subject to EPF contribution. Replied by Kap-Chew on topic PetrolFood Allowance is part of EPF Contribution.

Additionally the following list of payments must be included when calculating EPF contributions for employees in Malaysia. For example employee A earns RM6000 per month as their basic salary. Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them.

Hi Aries For any Variable Pay that you would not want to contribute for Tax SOCSO or EPF just uncheck the. Total monthly contribution RM2300. The Supreme Court has ruled that employers must take special allowances into account while calculating their contribution to an employees provident fund PF.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. The extent of the employers obligation to. Payments for unutilized annual or medical leave.

Allowance except travelling allowance is included in the definition of wages under the EPF Act. Can any one provide Include and exclude Allowances list under EPF. Membership of the EPF is mandatory for.

Updated May 6 2020. Section 431 EPF Act 1991. 5 years 5 months ago 1041.

However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference. For an employed Malaysian below the age of 55 who earns RM10000 a month. The current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time.

Payments Subject to EPF Contribution. Employers are legally required to contribute EPF for all payments of wages paid to the employees. Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as the EPF a social security fund established under the EPF Act to provide retirement benefits to employees working in the private sector.

Here what is the real meaning of Leave Bonus is to be examined from all legal perspective. Employees Provident Fund and Anr 2011 2 MPLJ 601 held that allowances forming part of salary are subject to PF contribution. Fixed payment to employees for vacation YES.

Dear Colleague Your Question is. Payment of handphone and pager allowances to employees YES Payment of handphone and pager charges directly to third party eg. How calculation works.

Service provider NO Reimbursement for handphone and pager expenses necessarily incurred for official purposes on behalf of employer NO Holiday expenses Is CPF payable. In short yes bonuses and cash allowances are considered to be part of your wages. The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of Malaysia Employees Provident Fund Act 1991 Act 452 which manages the compulsory savings plan and retirement planning for private sector workers in Malaysia.

Such allowances will be a part of the total emoluments given to an employee and therefore the 12 EPF contribution should be calculated on this total amount. Other incidental allowances which are related to traveling such as transport allowance outstation allowance food allowance car allowance handphone allowance are subject to EPF contributions UNLESS the said payments are reimbursement in nature. Other incidental allowances which are related to traveling such as transport allowance outstation allowance food allowance car allowance handphone allowance are subject to EPF contributions UNLESS the said payments are reimbursement in nature.

In a High Court case the Court held that payments described as reimbursement or travel allowance that were paid by the employer to the employee for trips he made while working as a driver in the company were incentives that are covered under the EPF Act 1991 and were subject to EPF contributions 4. The employee contributes 11 X RM10000 RM1100 per month. 2019 Deloitte Touche Tohmatsu India LLP Provident Fund applicability on allowances 4 Why this discussion Background Supreme Court rules allowances in question are subject to PF Impact on the industry far reaching and significant What we propose to cover What is basic wages under PF Act Judicial history Outcome of the ruling.

Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. The Supreme Court vide judgement dated 28 February 2019 in the case of Surya Roshni Ltd. In general all monetary payments that are meant to be wages are subject to EPF contribution.

Allowances except a few see below Commissions. The employer contributes 12 X RM10000 RM1200 per month. The nature of payment of conveyance and laundry allowance is to be.

Concession In Home Loan Interest Rates Clss Pmay U

What You Need To Know About Epf Accounts Businesstoday Issue Date Feb 28 2013

Difference Between Epf And Eps Employee Pension Scheme Ebizfiling

Sample Filled Form 15g For Pf Withdrawal In 2022

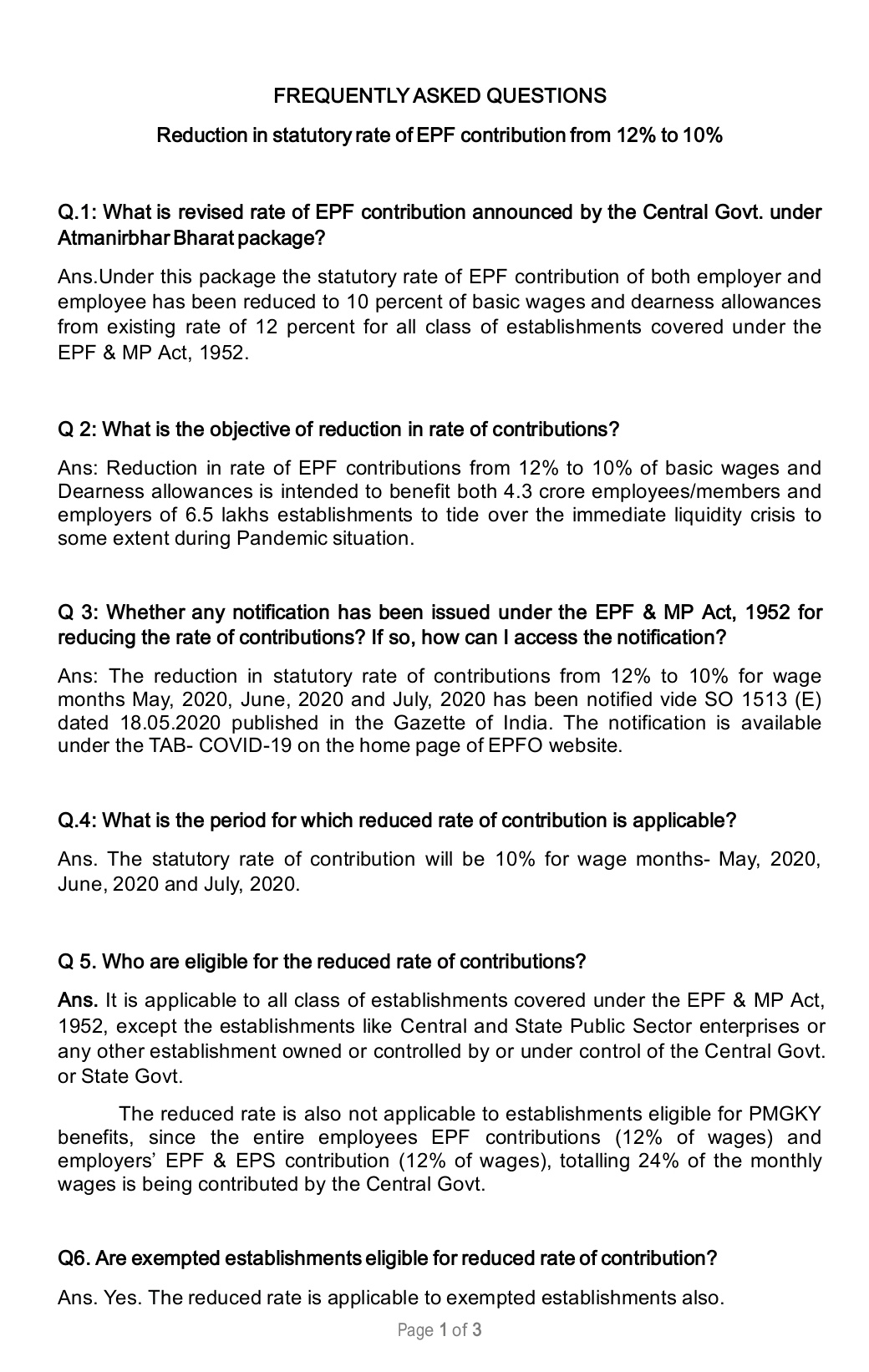

Epfo On Twitter Frequently Asked Questions About Reduction In Statutory Rate Of Epf Contribution From 12 To 10 Indiafightscorona Epfo Stayhomestaysafe Socialsecurity Https T Co Ojavinbtbc Twitter

Epf Withdrawal Rules 2022 All You Need To Know

Shopify Has Everything You Need To Start Selling Online Start An Online Store With Shopify S Robust Ecommerce Platf Selling Online Things To Sell Online Store

Epf A C Interest Calculation Components Example

Epf A C Interest Calculation Components Example

Why Epf Is Still A Winner Despite Lowest Rate In Over Four Decades

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Cash Management Guidelines Ministry Of Finance Clarification Dtd 17th February 2021 Cash Management Management Finance

What Payments Are Subject To Epf Donovan Ho

What Is Epf Deduction Percentage Quora

All About Epf Employee Provident Fund Enterslice

Epf Vs Eps Know The Major Differences And How It Works

All About Epf Employee Provident Fund Enterslice

Declaration Of Rate Of Interest For The Employees Provident Fund Members Account For The Year 2021 22 Https Www Staffnews In 2022 In 2022 Fund Accounting Government